Bridging the Gap to Homeownership

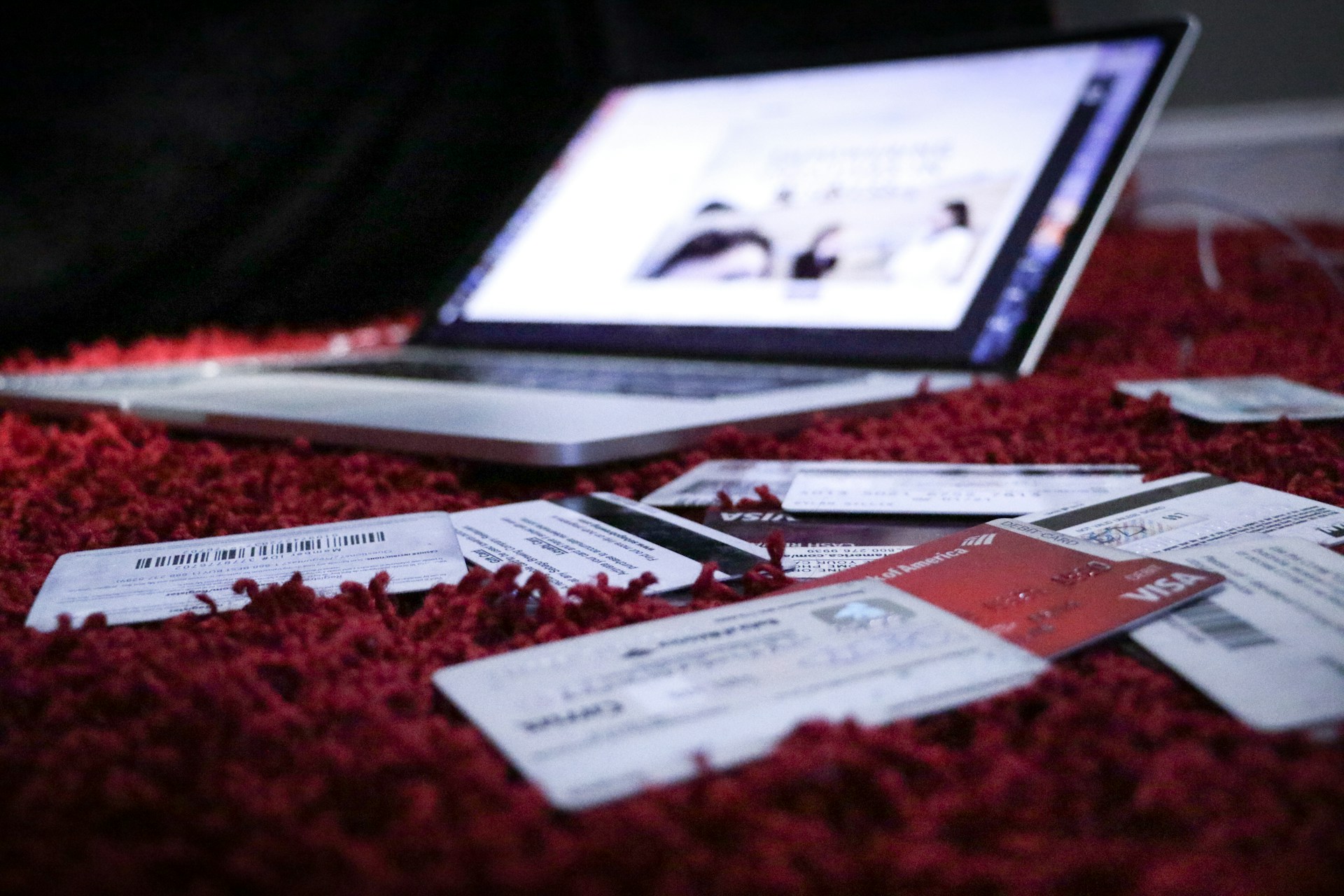

Are you dreaming of owning a home but finding it difficult to navigate the traditional home-buying process? Welcome to Rent to Owning Homes, your comprehensive resource for understanding and accessing the benefits of rent-to-own housing.

Step-by-Step Guides

Detailed step-by-step guides for every stage of the rent-to-own process.

Expert Advice

Access to real estate professionals, financial advisors, and legal experts.

Up-to-Date Insights

Regular updates on real estate market trends and rent-to-own opportunities.

Property Alerts

Customized email alerts for new rent-to-own property listings.

About

Our Story

Rent to Owning Homes was founded on the belief that everyone deserves the opportunity to own a home, regardless of their financial situation or credit history. We recognized a significant gap in the housing market for those who are unable to qualify for a traditional mortgage but are ready and willing to become homeowners.

Mission

Our Mission

Our mission is to make homeownership accessible to all by bridging the gap between renting and buying. By offering clear guidance, expert advice, and innovative tools, we aim to simplify the rent-to-own process, enabling our users to achieve their dream of homeownership with confidence and ease.

Benefits

Benefits of Rent To Own Homes

Build Equity While Renting

Unlike traditional renting, where your monthly payments do not contribute to homeownership, a portion of your rent in a rent-to-own agreement goes toward your future home purchase.

Try Out the Neighborhood

Renting the home before buying allows you to experience living in the property and neighborhood, ensuring it meets your long-term needs and expectations.

Lock in the Purchase Price

The option to purchase the home at a predetermined price can protect you from rising property values, allowing you to secure your home at today’s market rate.

Low Initial Investment

Rent-to-own agreements typically require a smaller upfront payment compared to traditional home purchases.

Improve Credit Score

If your credit score isn’t quite where it needs to be to qualify for a mortgage, the rent-to-own period gives you time to improve your creditworthiness while living in your desired home.

Enhanced Stability

Unlike standard rental agreements that can change annually, rent-to-own provides a more secure and predictable housing arrangement.

Benefit

Who Can Benefit from Rent to Own Homes?

First-Time Homebuyers

Those who are new to the housing market can benefit from the gradual transition to homeownership that rent to own offers.

Individuals with Less-Than-Perfect Credit

If you have a low credit score, a rent-to-own arrangement gives you time to improve your financial standing while securing your future home.

Self-Employed Individuals

Those with non-traditional income streams can use the rent-to-own period to establish a solid financial history for mortgage approval.

Relocating Families

Families moving to a new area can settle into their new home quickly without the immediate pressure of buying.

Stay Informed and Stay Ahead with Rent to Owning Homes

Subscribe to Rent to Owning Homes and unlock a world of valuable resources, expert advice, and exclusive updates to help you achieve your dream of homeownership through rent-to-own arrangements.

FAQs

Common Questions About Rent to Own Homes

What happens if I decide not to purchase the home?

If you choose not to buy the home at the end of the lease period, you may lose the option fee and any rent credits accumulated. However, you are not obligated to make the purchase.

Can I buy the home before the lease period ends?

Yes, many agreements allow you to exercise the option to purchase before the lease term expires, subject to the terms outlined in the contract.

What if the property value decreases?

While the predetermined purchase price protects you from rising values, it does not adjust for potential declines. It’s essential to consider market trends and seek professional advice.

Is rent to own available for all types of properties?

Rent-to-own agreements are commonly available for single-family homes, but you may also find options for condos, townhouses, and multi-family units.

What are the benefits of a rent-to-own agreement for someone with bad credit?

Rent-to-own agreements provide an opportunity for individuals with poor credit to improve their credit score and financial standing while living in the home they intend to purchase. This can make it easier to qualify for a mortgage when it’s time to buy the home.

Are rent-to-own contracts legally binding?

Yes, rent-to-own contracts are legally binding agreements between the tenant and landlord. It’s essential to thoroughly review and understand the terms of the contract before signing, and it’s advisable to seek legal advice to ensure you fully understand your rights and obligations.

Blog